The CPA certification offered by AICPA is globally recognised as the premier qualification for accounting professionals. Our goal is simple - to help you master the CPA curriculum and equip you with the knowledge tools and exam techniques to clear the exam and earn this coveted accreditation.

We have developed a complete online learning solution to prepare you for your CPA exams. The following three sections comprise the core of the exam —

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Taxation and Regulation (REG)

Each candidate must also pass a discipline section for licensure and at PwC's Academy we offer the Business Analysis and Reporting (BAR) as the discipline section.

Learn concepts with interactive, engaging training materials and online resources, including visual slides and exam‑style question banks.Review and recap your progress every few weeks, and put your learning to test with full mock exams after revision. What’s more, you get access to the Gleim Platinum Package - the world leader in CPA study materials - with a lifetime access.

Who is it for?

This is the right choice for you if you are looking to begin your career in accounting or enhance your financial advisory skills to upgrade your career.

You are eligible for CPA if you meet the following criteria:

- Bachelor’s degree in accounting, finance or business with 120 credits

- Minimum of 120 credit hours to be eligible to take the CPA exams

- Minimum of 150 credit hours and 1-2 years’ work experience to apply for a CPA license

Course structure

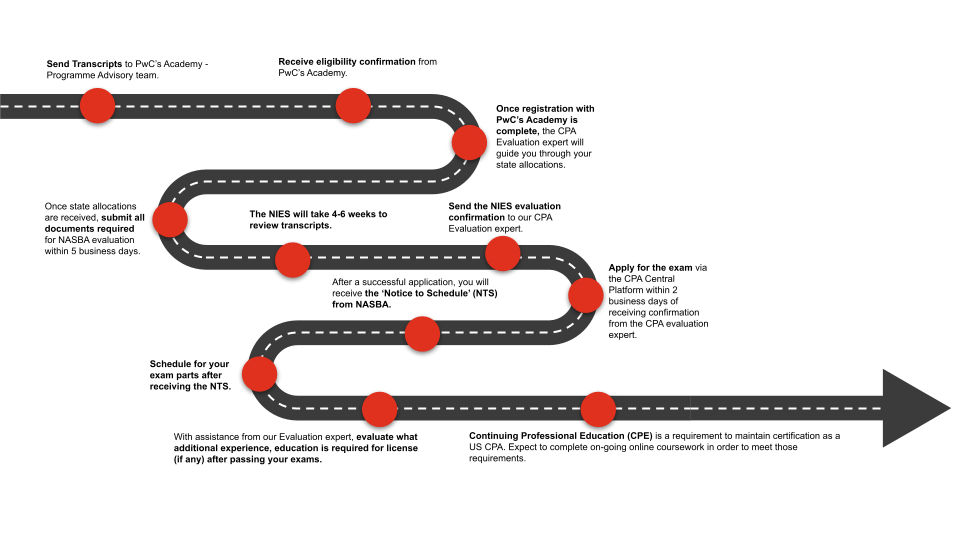

Your CPA journey with us

More about the Qualification

The American Institute of CPAs (AICPA) is the world's largest member association representing the accounting profession, with 431,000+ members in 130 countries. The AICPA provides educational guidance materials; develops and grades the Uniform CPA Examination; and monitors and enforces compliance within the profession. To learn more about the professional body click here.

For more information on the CPA exam click here.

Schedule

Programme details to be announced soon; watch this space.

FAQs

Connect with our team

For corporate enquiries:⠀⠀⠀ ⠀ ⠀ ⠀ Shruti Joshi

Manager - Client Relations⠀⠀ ⠀⠀ shruti.r.joshi@pwc.comFor corporate enquiries:⠀ ⠀⠀ ⠀⠀ ⠀ Amna Salim

Senior Manager - Client Relations ⠀ ⠀ amna.salim@pwc.com